Before Covid-19, we in the insurance world generally felt comfortable with the systems and strategies in place to ring-fence potential risk at first notification of loss. For example, ‘any previous claims’ is probably the most applied key indicator to measure potential risk on a case by case basis.

But a pandemic is a once in a lifetime serious situation to get through. The reality is that many good people have lost their jobs, cannot afford to pay their rent to keep a roof over the head of both them and those that depend on them. We know this because many policyholders have recently admitted COVID fraud to us and because as a psychologist, I know the theory is without question in full activation within the insurance market.

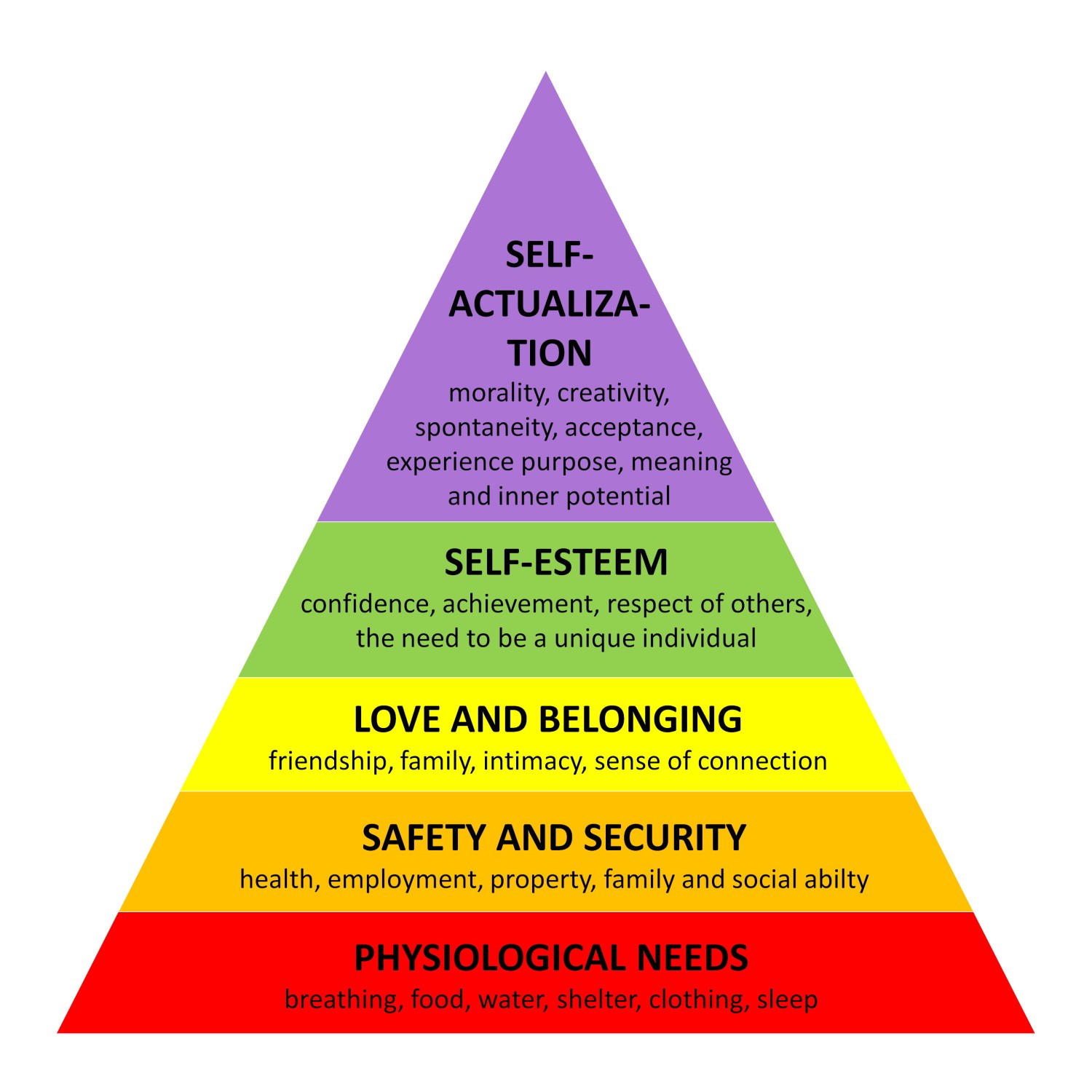

Psychologist Abraham Maslow first introduced his concept of a hierarchy of needs in his 1943 paper ‘A Theory of Human Motivation’. This hierarchy suggests that people are motivated to fulfil basic needs before moving on to other, more advanced needs. This theory has stood the test of time and remains true to this very day.

When a person’s life structure is threatened by external influence such as a pandemic or financial distress, the natural response is to drop to the bottom of the triangle and ensure its base is protected at all costs. It’s how we survive.

Now, the inherently good person is having to go through a process of self-justification (i.e. I would never claim on my insurance fraudulently but now, needs must). The motive is clear, the means are the policy. I am not saying all good people claim deceptively - far from it. What I am saying is that not only have we seen it in reality over the last 4 weeks and that this will continue for some time, but that it is a reality. People will do whatever it takes to survive if their situation is so dire and they simply have no choice.

[No alt text provided for this image]

It is therefore imperative that you realise good people, who would never have committed insurance fraud previously or even made a genuine claim, see their current situation as so drastic, they are naturally driven to find ways to secure fresh funds. Their policies can become that vehicle.

So be kind but think about behavioural psychology. Consider intelligence profiling as a must on each new claim you receive, get into the minds of your policyholders, walk in their shoes and you will truly see a completely different picture than you did before Covid-19. Profiling will give you that insight into new behaviours, new times and provide you with the second line of defence in triaging risk.